Trends are an important part of our industry. And "Market Pulse" published by the CGTA is a great source to understand

sales trends. But you need to know how to interpret it. We’ll show you how in this blog.

All vendors face long production lead times (4 to 6 months), so they simply can’t spot a

trend today and then have it ready for delivery tomorrow. They need to anticipate trends.

Consequently wholesalers have no choice but to take a guess about the future. And basically what they need to do is determine whether a category is growing or declining.

All vendors face long production lead times (4 to 6 months), so they simply can’t spot a

trend today and then have it ready for delivery tomorrow. They need to anticipate trends.

Consequently wholesalers have no choice but to take a guess about the future. And basically what they need to do is determine whether a category is growing or declining.

If a wholesaler anticipates that fewer retailers are

purchasing a product category, they will produce fewer products. No one wants to be stuck with inventory and

few potential customers.

On the other hand, if a wholesaler senses the number of

retailers interested in a category is growing it may produce more merchandise

in anticipation of higher demand. You don’t want to miss out on sales.

The ability to identify trends is important...lots of

money is at stake. How do you predict

growing or declining categories?

That’s why a simple comparison over only two periods is very

misleading. If we look at the longer

term trend (yellow line) of this category we see by it’s actually trending

slightly upwards…more stores are carrying this category each year.

That’s why a simple comparison over only two periods is very

misleading. If we look at the longer

term trend (yellow line) of this category we see by it’s actually trending

slightly upwards…more stores are carrying this category each year.

Home Decor shows this up and down pattern but the overall trend is clearly upward. This once again illustrates why you can't conclude anything from a single year-over-year change. It's the longer view which tells the true tale.

The up and down pattern is seen in Photo Frames, which also shows a long-term upwards trend.

It's a lot easier to see this when you know what to look for!

Candles vary randomly around the average although this is the only one that shows a bit of a downward trend.

Wallart is no exception. There is variation from year to year but you can count on basically half of all retailers carrying this product category.

All these examples serve to illustrate:

The best use of this data is to identify the number of potential customers in the category and whether it is sufficiently large enough for you to serve. If 50% of the retailers buy the category it's a lot of customers. Don't worry if the category is down one season or year...that's not a trend it's a data point!.

A trend is a consistent movement (up or down) in a market or

product category. The tricky part is correctly predicting

that movement. It's tricky because we have a natural bias to over-emphasize the importance of the last thing we saw, read or heard.

The CGTA through Retail News does a great job of collecting and

summarizing data from retailers across the country. It's truly an invaluable resource, They indicate the categories retailers are

stocking which helps to assess demand. However, you need to read this data carefully. In the recent Market Pulse issue, the magazine

noted big declines in the percentage of retailers stocking several important

categories. These were:

- Xmas and Seasonal Decor

- Candles and Home Fragrances

- Photo frames and Albums

- Wallart

- Home Decor

Now if you’re a wholesaler you may interpret this to be a

sign that you need to pull away from these categories because they are declining.

And if you’re a retailer you may also make the same judgement; if your peers seem to be getting out of a category you mayl be inclined to do so as well.

That may be a big mistake.

For instance Market Pulse noted a big decrease in "CHRISTMAS and SEASONAL

DÉCOR".

Coincidentally, over the years. I've frequently heard from some sales reps that “my retailers are getting out of Christmas”, although I haven't seen it in the results. We need to be aware that comments from a few retailers can never be interpreted as indicative of the market as a whole. And that’s a common mistake. Here’s how to avoid that pitfall.

|

2013

|

2012

|

difference

|

% difference

|

|

|

percent of stores stocking

|

68%

|

77%

|

-9%

|

-12%

|

Coincidentally, over the years. I've frequently heard from some sales reps that “my retailers are getting out of Christmas”, although I haven't seen it in the results. We need to be aware that comments from a few retailers can never be interpreted as indicative of the market as a whole. And that’s a common mistake. Here’s how to avoid that pitfall.

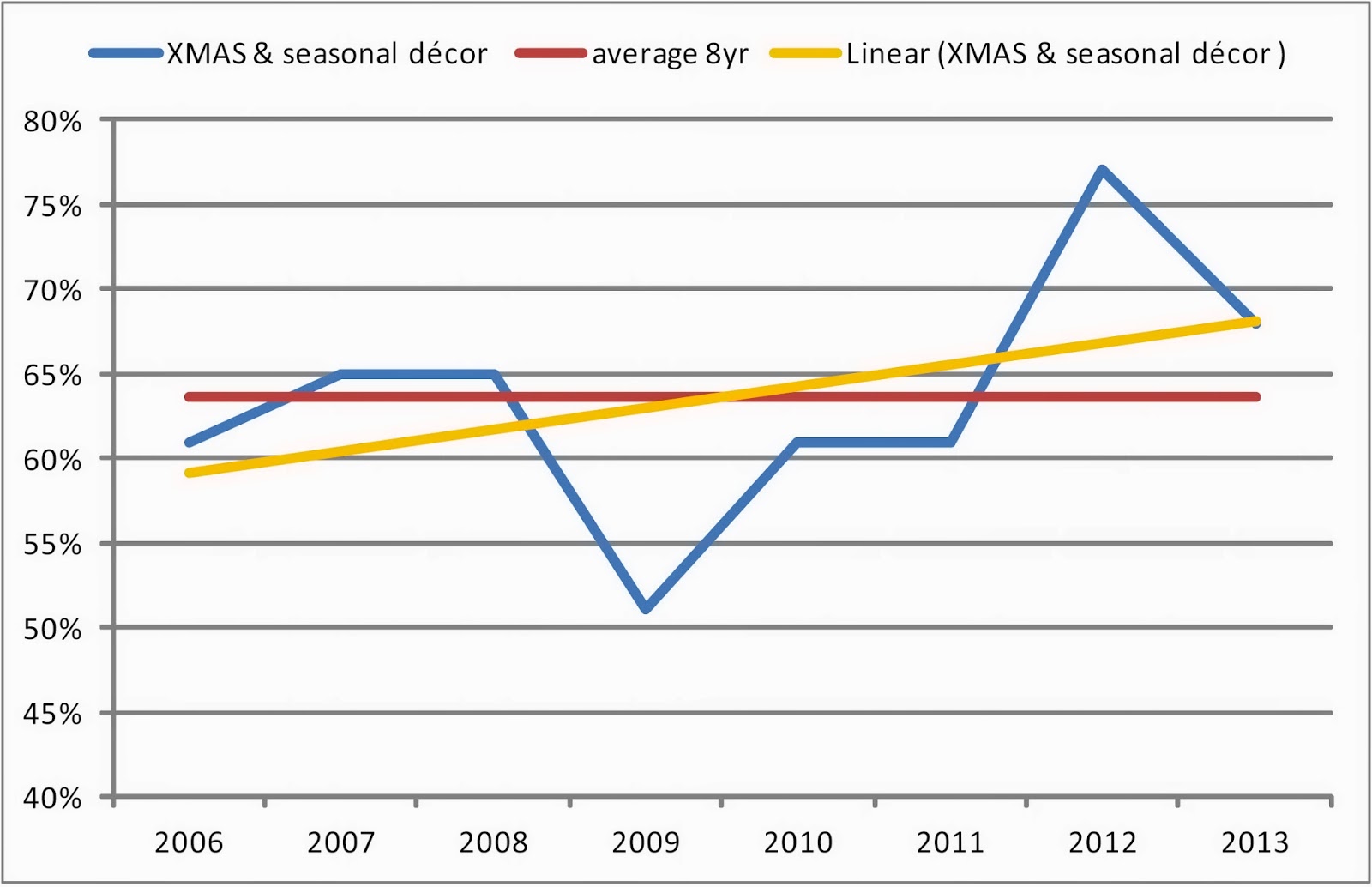

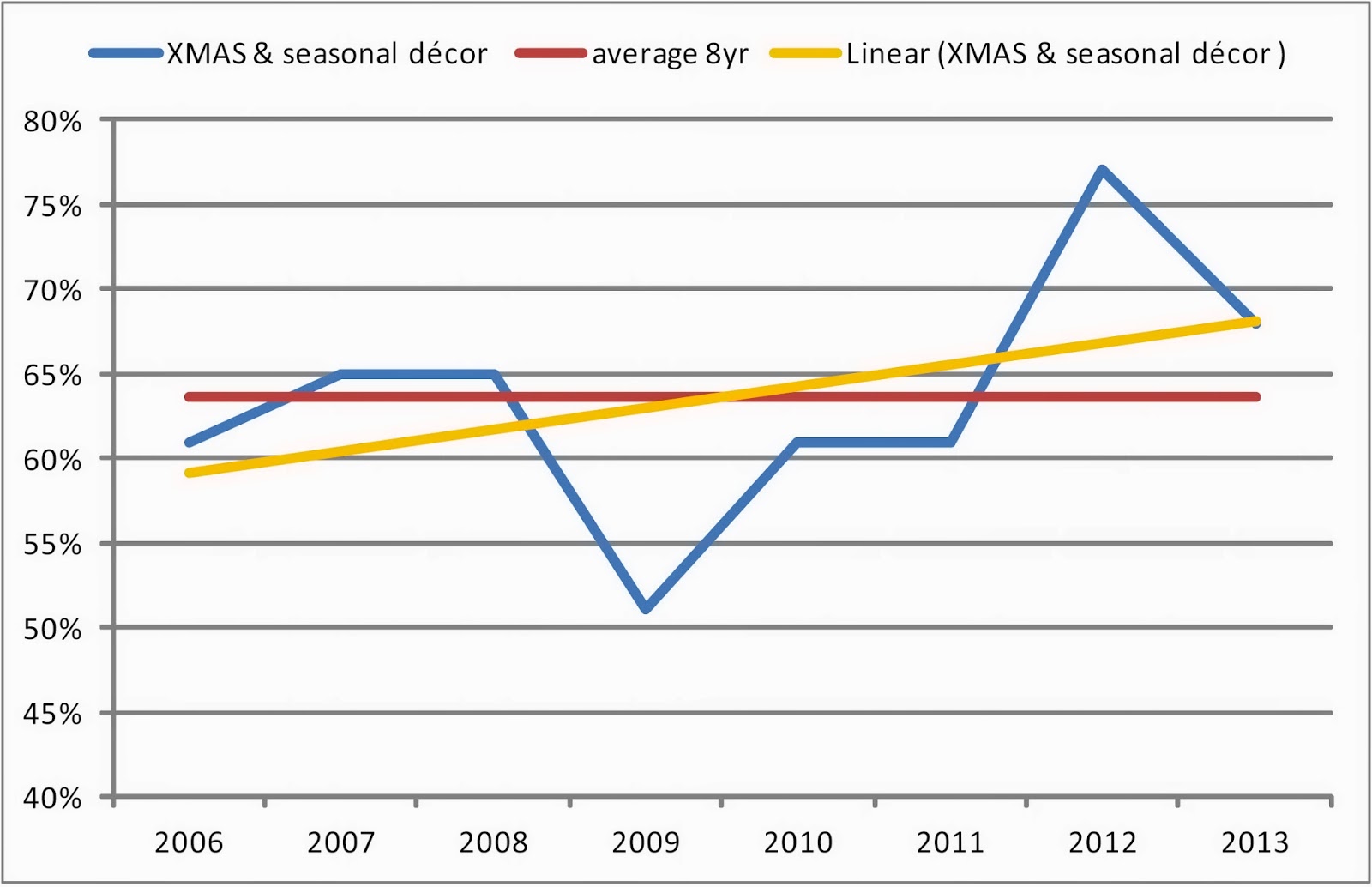

A SINGLE EVENT IS NOT A TREND

A trend is a general movement in a particular

direction. It's not a single

event. In the chart below, we see the Xmas

category over the last few years from data published in Market Pulse. This shows the percentage of retailers who purchase the category each year (the red line is simply the annual average):

Over the last 8 years there were:

- 4 years in which the category was purchased by an above-average number of customers

- 4 years in which the category was purchased by an below-average number of customers

This longer view sharpens our

perception and a different picture emerges. On average 64% of retailers

purchase this product category over this time period. Note the percentage of customers buying the category

moves up and down from the average rather randomly.

This up and down variance from the average is normal and really signifies nothing. (it is called regression to the average. Which basically means things fluctuate randomly around the overall average in the long term)

This up and down variance from the average is normal and really signifies nothing. (it is called regression to the average. Which basically means things fluctuate randomly around the overall average in the long term)

So why is there a fluctuation from year-to-year?

Now probably a few retailers have indeed stopped carrying the category just as a few probably added it. But another reason may simply be due to who the CGTA contacted for their survey. We can assume they don’t survey exactly the same stores every year. In one year they may simply have surveyed a few more stores who carry Xmas, skewing the data upward. In some years they may simply have surveyed proportionately more stores who never carry Xmas, hence the decrease. That’s why a simple comparison over only two periods is very

misleading. If we look at the longer

term trend (yellow line) of this category we see by it’s actually trending

slightly upwards…more stores are carrying this category each year.

That’s why a simple comparison over only two periods is very

misleading. If we look at the longer

term trend (yellow line) of this category we see by it’s actually trending

slightly upwards…more stores are carrying this category each year.

What you can conclude from this? The most important thing a wholesaler should

understand is that 65% of the customers they serve buy this category. That’s it! The fluctuation in any year is irrelevant and unpredictable.

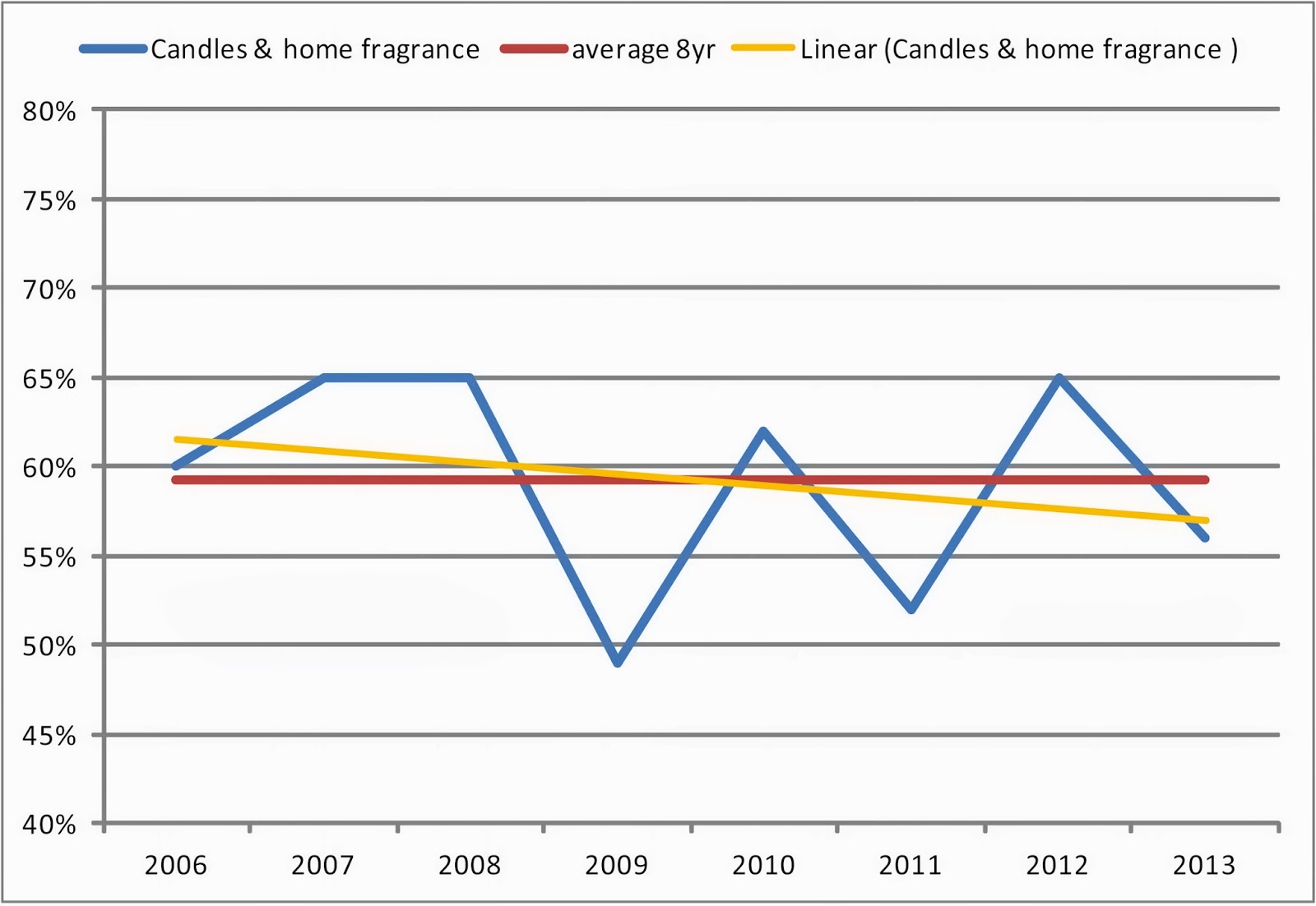

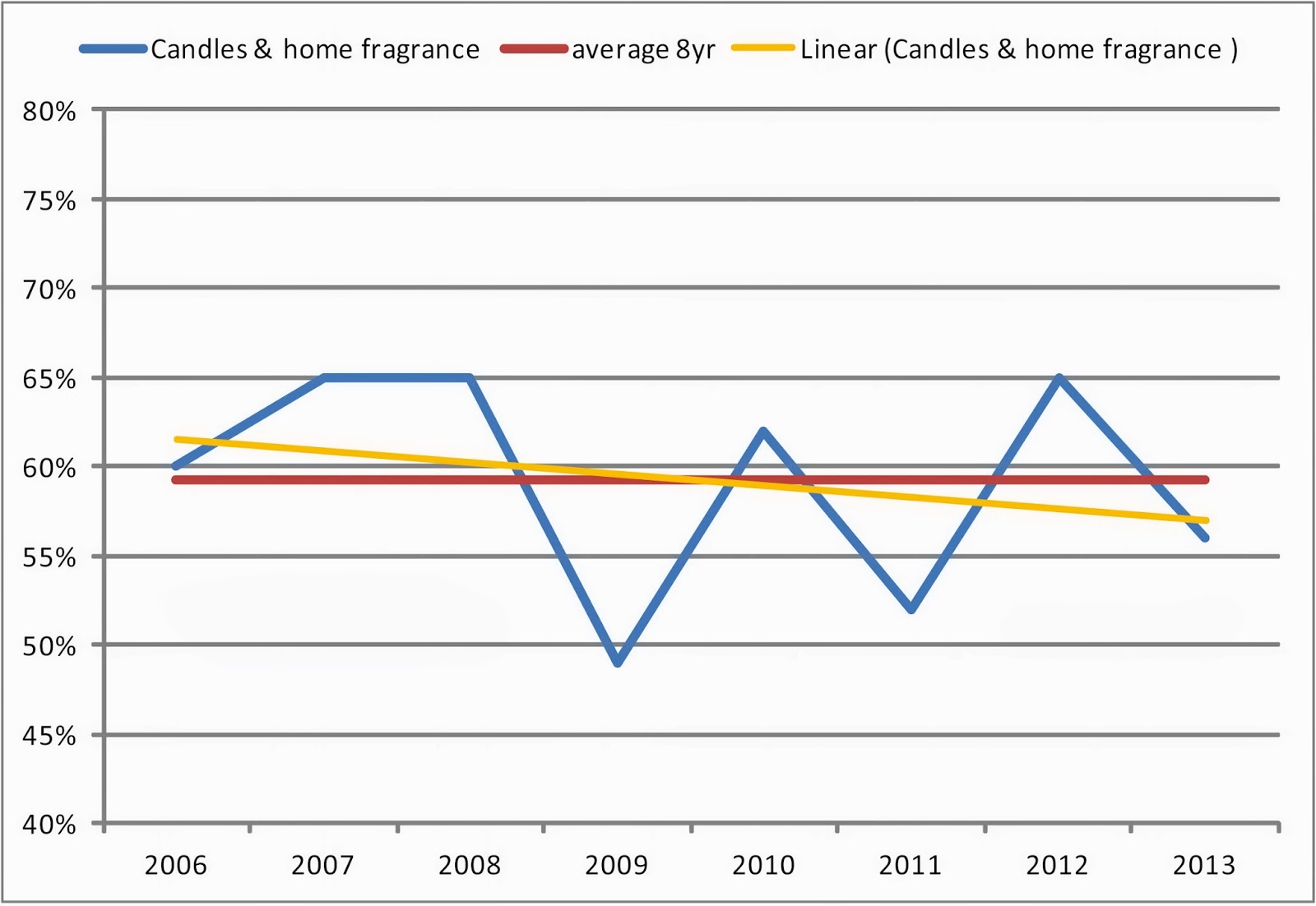

ALL CATEGORIES VARY RANDOMLY EACH YEAR

In fact, if you look at the long term data for any category you see that the percentage of retailers stocking the category varies up and down from the average every year in a random fashion.Home Decor shows this up and down pattern but the overall trend is clearly upward. This once again illustrates why you can't conclude anything from a single year-over-year change. It's the longer view which tells the true tale.

The up and down pattern is seen in Photo Frames, which also shows a long-term upwards trend.

It's a lot easier to see this when you know what to look for!

Candles vary randomly around the average although this is the only one that shows a bit of a downward trend.

Wallart is no exception. There is variation from year to year but you can count on basically half of all retailers carrying this product category.

All these examples serve to illustrate:

- all categories vary each year; it's quite normal and does not have particular significance

- you can’t identify a trend by simply comparing two periods.

The best use of this data is to identify the number of potential customers in the category and whether it is sufficiently large enough for you to serve. If 50% of the retailers buy the category it's a lot of customers. Don't worry if the category is down one season or year...that's not a trend it's a data point!.

HOW TO USE MARKET PULSE TO GET AN EASY SALES GAIN.

Here is an example of how a vendor I worked with got an easy

big gain. This vendor did not sell

Wallart.

Now the Wallart category as we saw in the chart above is

big. Over half the retailers carry this category. That’s a lot of customers. So we entered the category. Our first season (6 months) result was over

$100,000. Not bad when you consider that

the biggest effort to select the category was to simply look at a chart and see that

half the CGTA buys this category.

And how did we select products for our new Wallart category. Well we can't give away all our secrets can we? But here is a hint at how we did it.

And finally the most important factor: No matter how good you are at spotting trends and selecting product, you won't get very far without an excellent sales team.

And finally the most important factor: No matter how good you are at spotting trends and selecting product, you won't get very far without an excellent sales team.

No comments:

Post a Comment